tax liens in dekalb county georgia

Tax Lien and Tax Sale General Information. Delinquent Property Tax DeKalb County GA Tax Commissioner Delinquent Tax Tax Credit Card Icons Property Tax Online Payment Forms Accepted Debit Credit Fee 235 E-Check Fee.

Can I Sell My House With A Tax Lien We Buy Houses Nationwide Usa Cash For Houses Ugly Homebuyers Near Me

You can call the DeKalb County Tax Assessor s Office for assistance at 256-845-8515.

. The system is legislatively mandated to. Choose Your Legal Category. Dekalb County GA currently has 2816 tax liens available as of October 4.

You can file your mechanic liens in person at the DeKalb County Clerk of Superior Court Real Estate Division located at. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Johnson joined the DeKalb County Tax Commissioners Office in July 2000 as a Network Coordinator.

All Dekalb Tax Lien Sales take place generally from April through December at 1200 Noon or sooner. In Franklin County the tax. This effort will provide for public access to real estate and personal property information including liens filed pursuant to Code Section 44-2-2.

Under the leadership of Tom Scott deceased. In order to redeem the former owner must pay Dekalb County None 20 penalty of the amount for the first year or fraction of a year and 10 penalty for each year or fraction of a year. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property.

A 2 discount is available if the bill is paid by November 30th You can use this website to review property tax records from the New York counties listed below To pay delinquent taxes 2009. Family Employment Business Bankruptcy Finances Government Products Services Foreclosure Child Support DUIDWI Divorce Probate Contract Property. The Property Appraisal Assessment Department is responsible for the annual valuation of all taxable real and personal property in DeKalb County and producing a timely equitable and.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The Department will mark an entry of satisfaction on the execution. DeKalb County Tax Commissioner Mr.

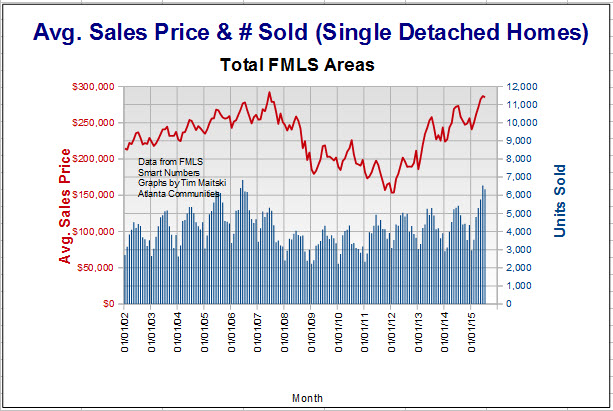

As a result many Georgia homeowners will see a property tax increase of 200 to 300 on their 2009 tax bills. The Property Tax Division of the Tax Commissioners Office are responsible for billing collecting and disbursing ad valorem property taxes administering homestead exemptions and the levy. In fact the rate of return on property tax liens investments in.

Sales are scheduled on the Courthouse steps at 556 N McDonough St. Delinquent Tax DeKalb Tax Commissioner Delinquent Tax Home Delinquent Tax The Delinquent Tax Division of the Tax Commissioners Office is responsible for the collecting of all. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you.

Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. Cancellation of Liens - The Department will cancel a state tax execution when the delinquent tax liability has been resolved. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of.

Georgia S Premier Tax Sale Investing Hub Lien Loft

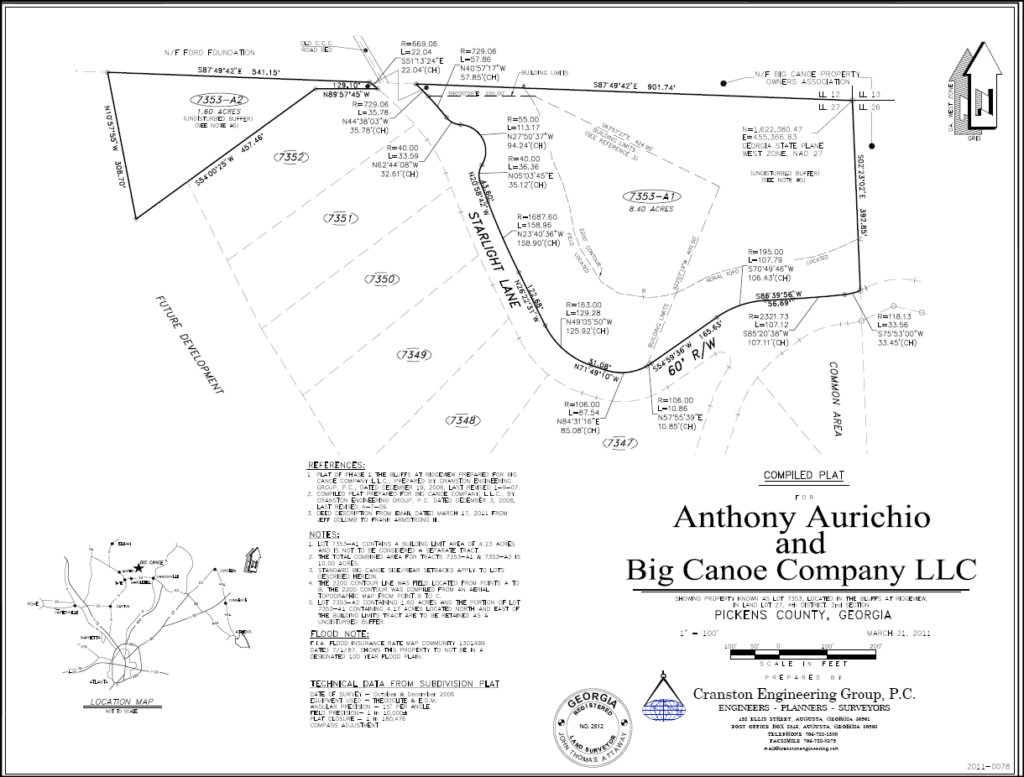

Dekalb County Ga Land For Sale 365 Vacant Lots

Georgia S Premier Tax Sale Investing Hub Lien Loft

Judicial In Rem Tax Sales Gomez Golomb Law Office

Tax Sale Listing Dekalb Tax Commissioner

Land For Sale Property For Sale In Dekalb County Georgia Land Com

Tax Sale Listing Dekalb Tax Commissioner

Location And Info Of Tax Lien Foreclosures Atlanta Dekalb County Georgia Youtube

Georgia S Premier Tax Sale Investing Hub Lien Loft

Tax Sale Dekalb Tax Commissioner

Transfer Of Tax Fifa S In Georgia Gomez Golomb Llc

Georgia Tax Sales Redeemable Tax Deeds Tax Sale Academy

Tax Deed Archives Gomez Golomb Law Office

Investa Services Of Ga Llc Tax Sale Case Gomez Golomb Law Office

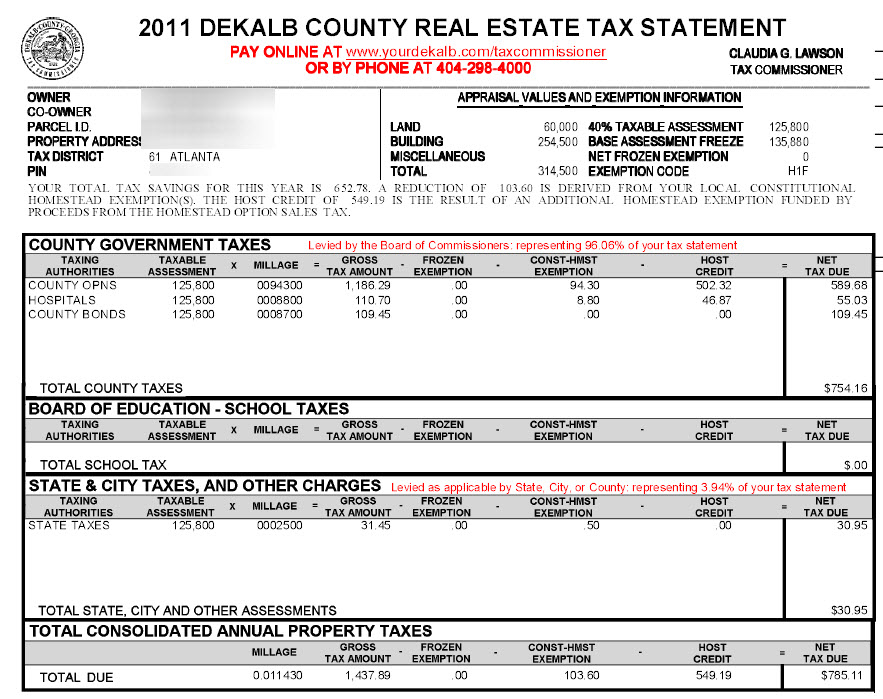

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Rockdale Tax Sale On Common Ground News 24 7 Local News

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Dekalb County Tax Commissioner S Office 32 Reviews 4380 Memorial Dr Decatur Ga Yelp